2026 Financial Markets: Balancing Geopolitical Resilience and Sector Volatility

Despite a tense geopolitical backdrop at the start of the year, financial markets are showing remarkable resilience. However, this strength masks heightened volatility and growing concerns regarding the technological pillars of the economy.

Despite a tense geopolitical backdrop at the start of the year, financial markets are showing remarkable resilience. However, this strength masks heightened volatility and growing concerns regarding the technological pillars of the economy.

2026 has hit the ground running, to say the least. This is particularly striking on the geopolitical front, with numerous sources of tension: Venezuela, Greenland, Iran… Yet, this has had very little impact on financial markets, whether in equities or bonds.

It is also worth noting the strong performance of emerging markets at the start of this year, following their momentum from 2025. This serves as another reminder of the importance of maintaining balanced and diversified portfolios—something a standalone investment in the MSCI World index cannot provide, as it is 70% composed of U.S. companies and lacks exposure to emerging markets.

Extreme Volatility in Safe-Haven Assets and Currencies

While markets are holding up well, they remain volatile and sometimes appear to lack clear direction:

-

Oil: Prices soared by 10% in just 3 days before suddenly dropping (following the evolving situation in Iran).

-

Gold: It surged from $4,600 to $5,600 per ounce in only 8 days, only to return to $4,600 within 48 hours! This stress, linked to the weakening dollar and the appointment of the next Federal Reserve Chair, Kevin Warsh, reminds us that gold remains a risky and relatively volatile financial asset.

-

Bitcoin: Often dubbed "digital gold," it continues its decline, hovering around $70,000 (compared to $127,000 in early October).

-

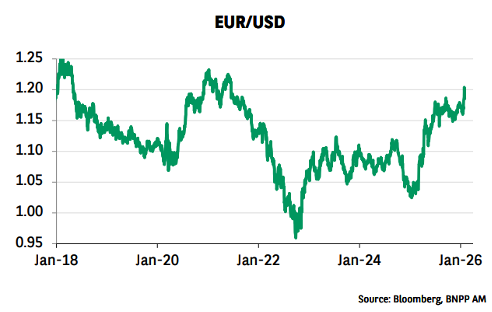

The Euro: It briefly crossed the $1.20 mark on January 27, sparking concerns within the ECB: while a strong euro reduces energy import costs, it hampers our exports.

The Tech Sector Facing the AI Profitability Challenge

In the equity markets, anxiety is mounting over AI and its consequences: the impact on specific sectors (software publishers, advertising agencies, legal professions) and the profitability of colossal investments in data centers. This reached a point where Microsoft shares dropped 10% in a single day following its results. Since this is a cornerstone stock, it raises serious questions for the other "Magnificent 7" (Nvidia, Meta, Apple, Alphabet, Tesla, and Amazon).

Finally, let’s take a step back: on an economic level, the latest news is rather encouraging in Europe and the United States. Statistics are trending positively, particularly for industrial investments driven by technology. Concerns are now shifting toward rising unemployment, inflationary risks, and the future stance of central banks.