Between Monetary Hopes and Technological Doubts

Amid rising investor caution, strong expectations around central banks and mixed signals from global growth, the past month proved eventful. The environment remains uncertain, yet still supportive, provided key risk factors are closely monitored. January 2026.

Amid rising investor caution, strong expectations around central banks and mixed signals from global growth, the past month proved eventful. The environment remains uncertain, yet still supportive, provided key risk factors are closely monitored. January 2026.

Uneven price action but overall resilience

It would be hard to describe the past month as a calm one. Questions surrounding equity valuations on the one hand, and the massive scale of investment in artificial intelligence on the other (close to USD 400 billion this year and an estimated USD 500 billion next year), have clearly increased investor nervousness. This resulted in sharp swings across asset classes, strong performance from gold, and, conversely, significant pullbacks in some higher-risk assets such as cryptocurrencies and technology stocks.

The final week of the month nevertheless brought a rebound, allowing global equity indices to end November with performance close to flat overall.

Central banks, geopolitics and investor expectations

In this more fragile environment, investors are closely watching upcoming decisions from the US Federal Reserve, hoping for another interest rate cut as early as December 10. Markets are also awaiting the announcement of the successor to current Fed Chair Jerome Powell, after Donald Trump indicated that a decision has already been made. Kevin Hassett, Director of the National Economic Council and a close ally of the President, is widely seen as the leading candidate.

Meanwhile, negotiations aimed at bringing the war in Ukraine to an end have reportedly made meaningful progress in recent weeks. From a financial perspective, a positive outcome would undoubtedly support European assets and, more broadly, improve confidence among economic agents.

Global economy: regional contrasts and the pivotal role of AI

From a macroeconomic standpoint, the data released in November (limited in the US due to the prolonged government shutdown) point to resilient growth overall, with the notable exception of China, where consumption remains subdued and the real estate sector continues to face financial stress.

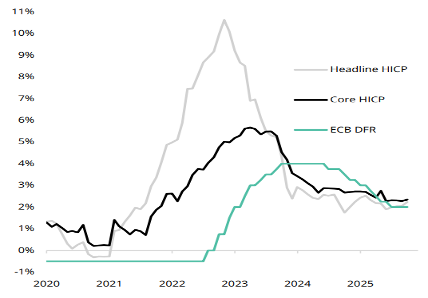

In the euro area, economic activity is holding up well, inflation remains under control — allowing the ECB to lower interest rates — and Germany’s ambitious investment programme is beginning to generate cautious optimism for the year ahead.

Euro area: inflation and ECB policy rate

Source: Silex, Factset

In the United States, the technology and artificial intelligence sectors continue to underpin economic growth. Household consumption also remains strong despite higher tariffs, culminating in a new spending record during Black Friday. That said, inflation remains slightly too high, at around 3%, while labour market conditions are gradually deteriorating.

Overall, the global backdrop remains broadly supportive for financial assets, although equity valuations are elevated in certain segments. The main short- to medium-term risks are well identified: persistently high inflation in the US, which would prevent the Fed from easing policy further, and a potential slowdown in the “AI engine” should investments prove excessive or fail to deliver sufficient returns.

From Switzerland: insights from our Geneva-based partner

Two positive developments are worth highlighting this month:

-

voters overwhelmingly rejected a proposal to significantly increase inheritance taxes on large fortunes, which would have undermined the country’s attractiveness;

-

negotiations on US import tariffs applied to Swiss goods have concluded successfully, resulting in a substantial reduction from 39% to 15%.