Financial Markets: Volatility, Monetary Expectations and Mixed Global Signals

Amid heightened volatility, concerns over stretched valuations and massive artificial intelligence investments have kept financial markets on edge. As investors await central bank decisions and monitor geopolitical developments, global economies continue to move at different speeds, with US resilience, Chinese weakness and European stability shaping the outlook. December 2025.

Amid heightened volatility, concerns over stretched valuations and massive artificial intelligence investments have kept financial markets on edge. As investors await central bank decisions and monitor geopolitical developments, global economies continue to move at different speeds, with US resilience, Chinese weakness and European stability shaping the outlook. December 2025.

Growing Nervousness Over Valuations and Massive AI Investments

This time, we certainly cannot say that last month was calm in the markets. Questions surrounding valuations on the one hand and the massive spending in AI on the other (close to 400 billion dollars this year and 500 billion next year) have started to make investors more nervous. This resulted in strong volatility, a very solid performance for gold prices, and conversely, sharp declines for certain risky assets such as cryptocurrencies and technology stocks. The last week of the month nonetheless brought a rebound, which ultimately allowed global equity markets to end November with a performance close to flat.

Monetary Policy, Geopolitics and Diverging Economic Trends

In this more fragile context, markets are eagerly awaiting the next decisions from the Fed, the US central bank, hoping for a new rate cut as early as December 10. They are also awaiting the name of the successor to current chair Jerome Powell, as Donald Trump has indicated he has made his choice: it appears that Kevin Hassett, Director of the National Economic Council and of course close to the president, is the frontrunner.

Meanwhile, negotiations aimed at ending the war in Ukraine have reportedly made significant progress in recent weeks. For financial markets, a favorable outcome would undoubtedly be good news for European markets and, more broadly, for overall economic confidence.

On the economic front, the statistics published in November (although sparse in the United States due to the long government shutdown) showed resilient growth, except in China, which remains plagued by weak consumer spending and a financially distressed real estate sector.

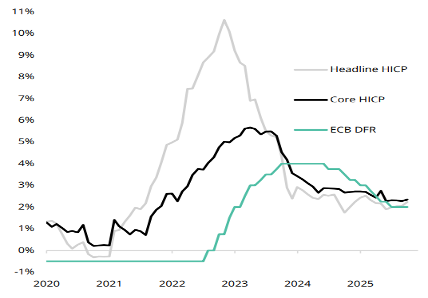

In the Eurozone, economic growth is holding up well, inflation is under control (allowing the ECB to cut rates), and the ambitious German investment plan is raising some hopes for next year.

Eurozone: Inflation and ECB Policy Rate

Source: Silex, Factset

In the United States, the technology/artificial intelligence sector continues to support economic growth. Moreover, household consumption remains strong despite higher tariffs, highlighted by a new spending record on Black Friday. On the other hand, inflation remains somewhat too high, close to 3%, and the labor market is deteriorating.

Overall, the global landscape still appears relatively favorable for financial markets, although equity valuations are sometimes high. The main short- and medium-term risks are well known: inflation that remains too strong in the United States (which would prevent the Fed from cutting rates), and of course a potential slowdown in the “AI engine,” should investments prove excessive and insufficiently profitable.

Switzerland: Political and Trade Decisions Fuel Optimism

From Switzerland, here is the viewpoint of our partner based in Geneva:

Two positive developments stand out this month:

• Voters overwhelmingly rejected a proposed law seeking heavy taxation on large inheritances (which would have harmed the country’s attractiveness);

• Negotiations regarding US-imposed tariffs on Switzerland have finally led to a sharp reduction, from 39% down to 15%.