Why supplementary health insurance premiums will rise again in 2026

By Nicolas Medan, Managing Partner of KMH Benefits.

When I wrote earlier this year about the first signals of higher health insurance rates in France, it was based on conversations with insurers, clients, and peers. Renewal season always brings tension — budgets, promises, and expectations colliding.

By Nicolas Medan, Managing Partner of KMH Benefits.

When I wrote earlier this year about the first signals of higher health insurance rates in France, it was based on conversations with insurers, clients, and peers. Renewal season always brings tension — budgets, promises, and expectations colliding.

Now, with the Comptes de la santé 2024 published yesterday (30 September 2025) by the French statistics office DREES, we have confirmation: the cost burden is shifting, and it will translate into another round of premium increases in 2026.

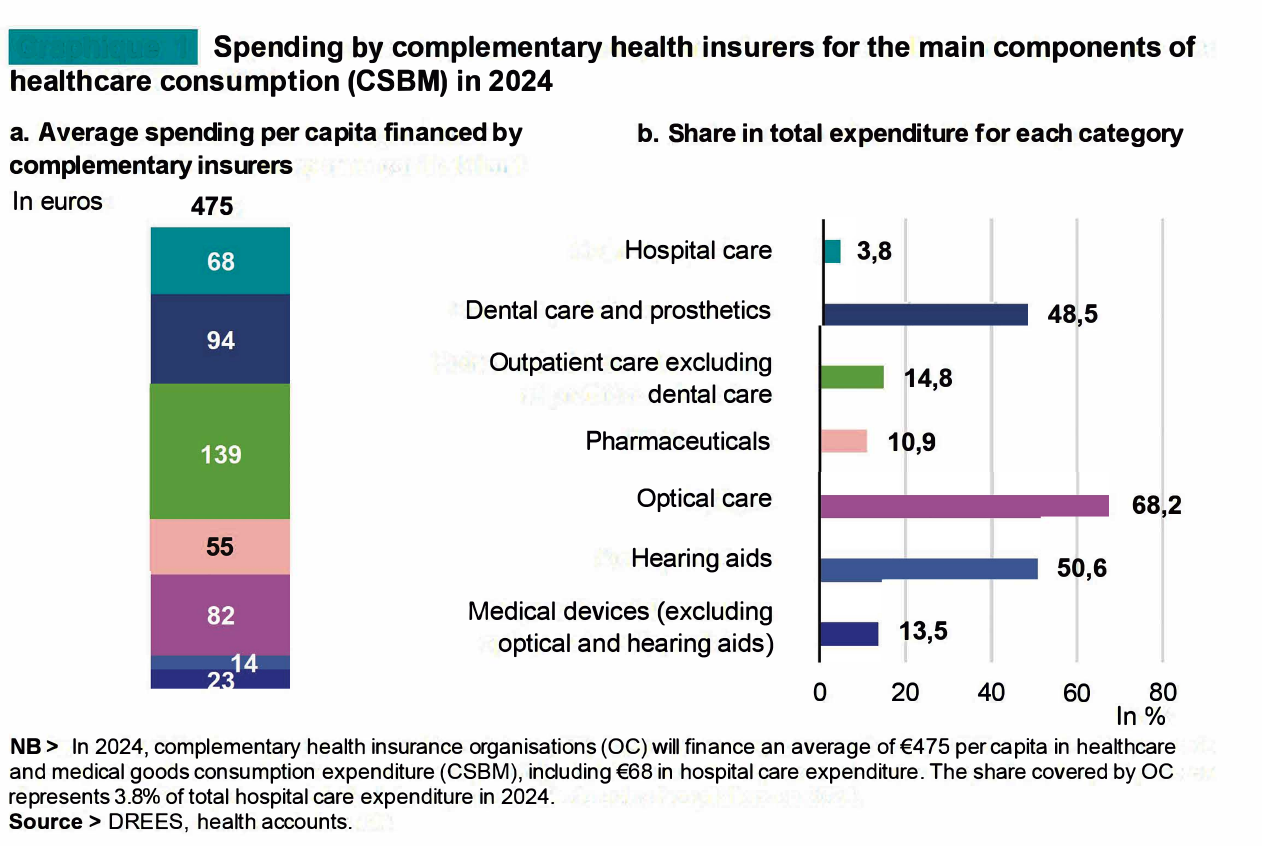

The report is clear. Supplementary health insurers (the organismes complémentaires) paid out €32.5 billion in benefits in 2024, or €475 per person. That represents a 6.2% increase in one year, double the pace observed in 2022.

What drives this acceleration?

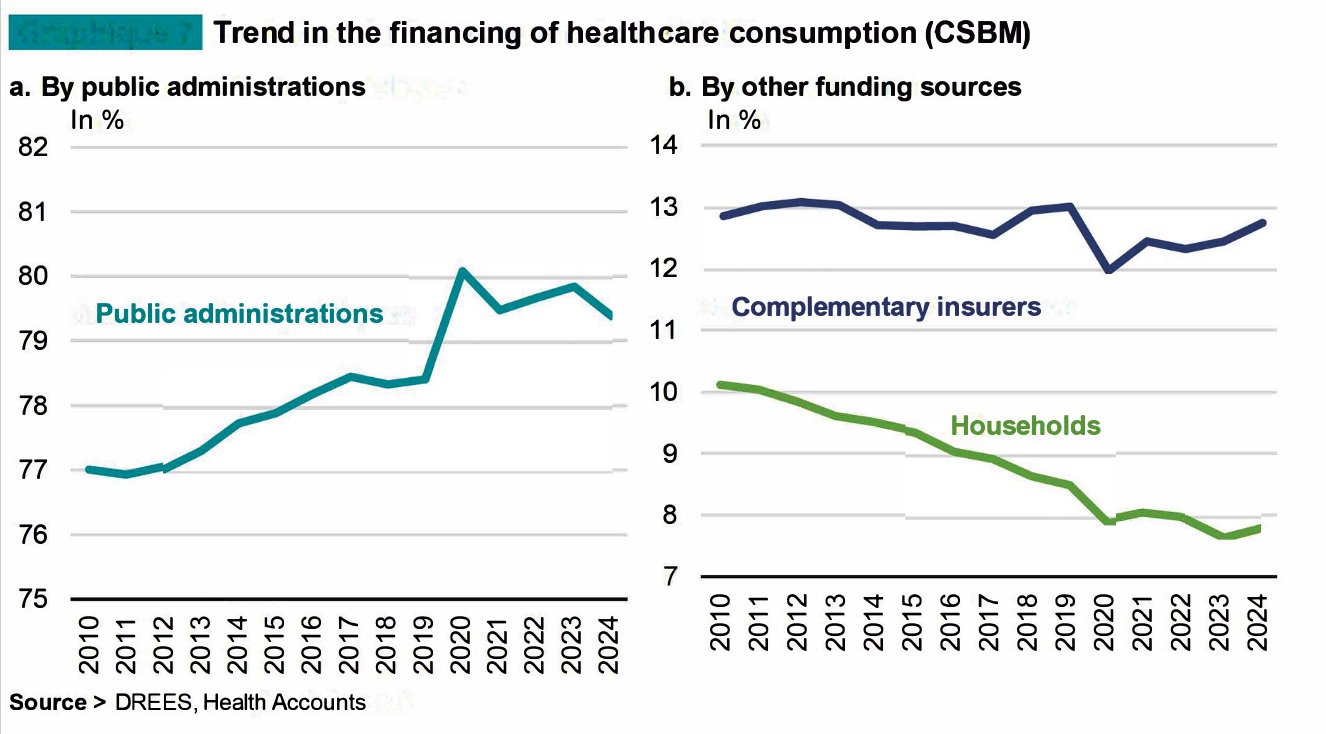

- A growing share for insurers: complementary health coverage financed 12.8% of overall medical consumption (CSBM) in 2024, edging back to pre-Covid levels. In other words, insurers are picking up more of the bill as the State pays relatively less.

- Costly medical segments:

- Dental care, 48.5% financed by insurers (€6.4bn)

- Optical care, 68.2% (€5.6bn)

- Hearing aids, 50% (€1bn)

Together, these three categories account for 40% of total complementary spending.

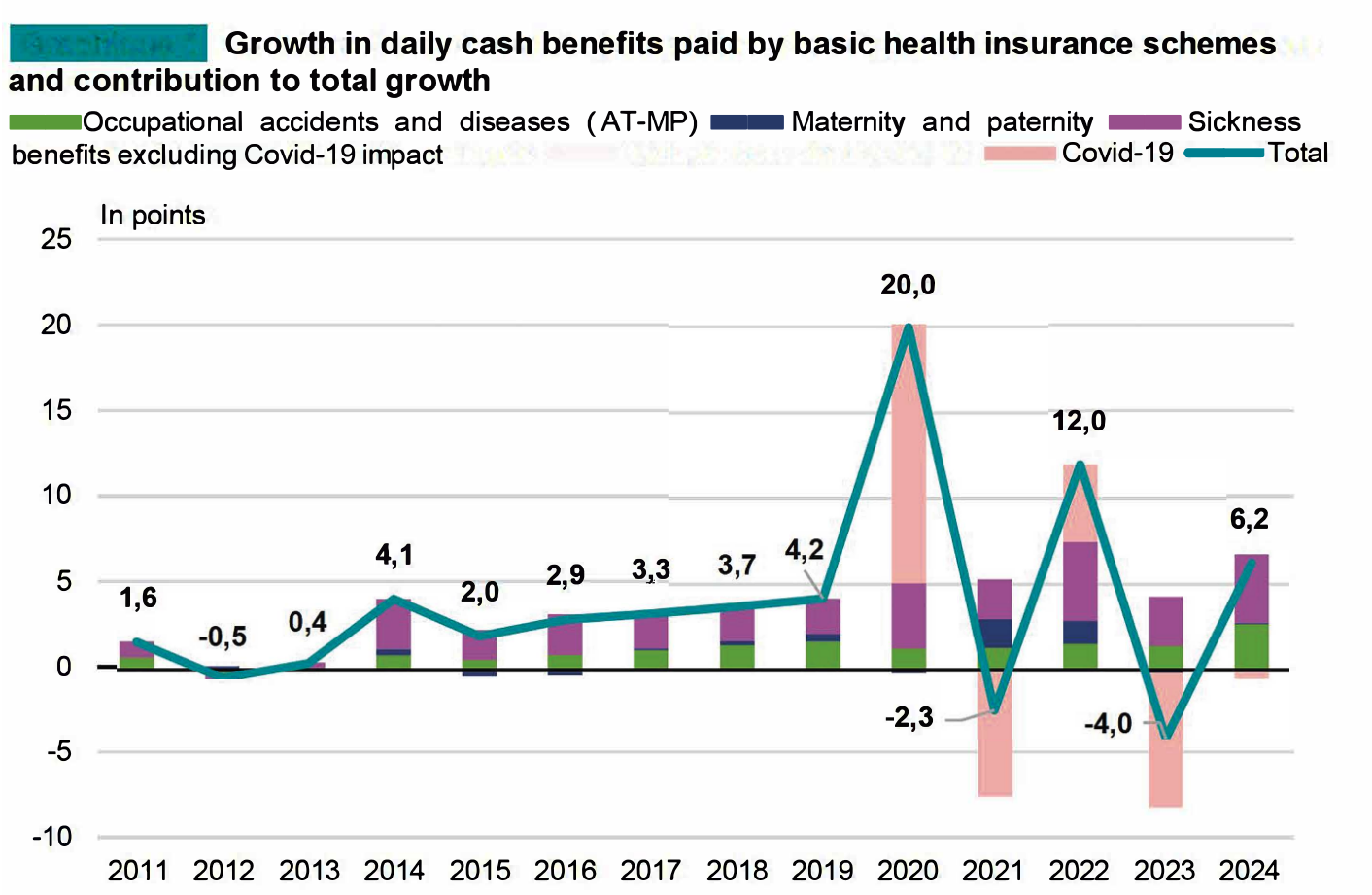

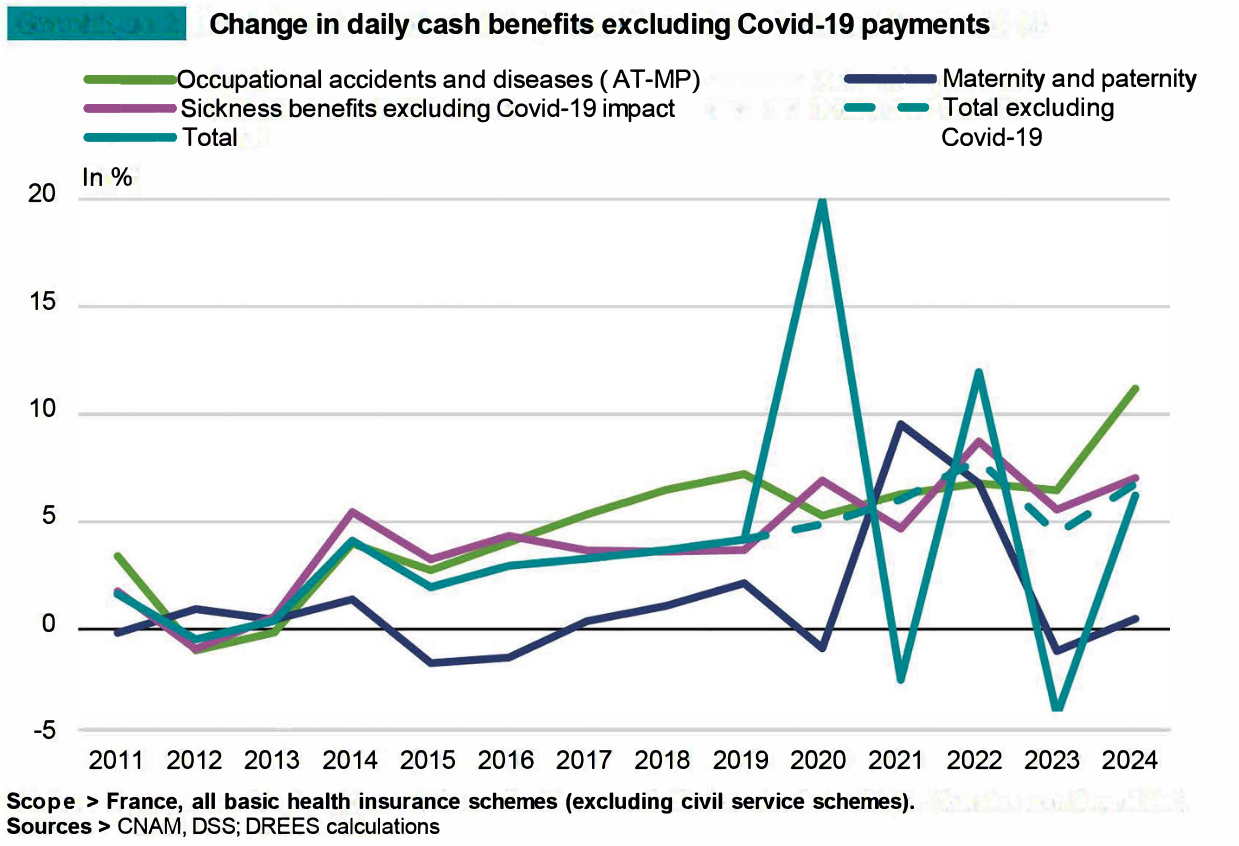

- Sick leave and income protection: complementary insurers also paid out €7.4bn in daily allowances in 2024, up 7% year-on-year. Absenteeism, already a growing concern for employers, is directly feeding into higher insurance costs.

The market structure is also telling.

Mutual insurers remain the largest player (with €14bn in benefits), followed by commercial insurers (€11.9bn) and provident institutions (€6.5bn). All three are exposed to the same pressure: higher claims, shifting costs, and the need to pass this through to premiums.

For employers, the takeaway is straightforward: premium increases are not simply an actuarial adjustment, they reflect a structural rebalancing of who pays for healthcare in France. The social security system is gradually stepping back, leaving more to insurers, households, and companies.

That reality will define 2026 renewals. As always, there will be negotiations and fine-tuning — but the direction is clear. Employers need to prepare for higher costs, while employees will expect sustained protection in a system where the “second payer” is becoming, more and more, the first line of defense.

Source(s) :